The Facts About Ia Wealth Management Revealed

Wiki Article

Lighthouse Wealth Management Can Be Fun For Anyone

Table of Contents7 Easy Facts About Ia Wealth Management DescribedThe Buzz on Private Wealth Management CanadaIndependent Financial Advisor Canada Can Be Fun For EveryoneNot known Facts About Investment RepresentativeSee This Report about Independent Financial Advisor CanadaFinancial Advisor Victoria Bc - Questions

“If you had been buying something, say a tv or a computer, you'll need to know the requirements of itwhat are its components and what it can create,” Purda details. “You can contemplate purchasing economic guidance and assistance just as. Folks must know what they are purchasing.” With financial guidance, it is important to remember that this product isn’t ties, shares or other assets.It’s such things as budgeting, planning retirement or paying off personal debt. And like getting a personal computer from a trusted company, customers want to know these include buying economic guidance from a dependable specialist. Among Purda and Ashworth’s most interesting results is around the charges that economic coordinators cost their customers.

This conducted genuine it doesn't matter the cost structurehourly, commission, possessions under control or flat fee (in the learn, the buck worth of costs had been alike in each instance). “It still comes down to the worthiness idea and doubt about customers’ part that they don’t know very well what they are getting into exchange for these fees,” says Purda.

Tax Planning Canada Can Be Fun For Everyone

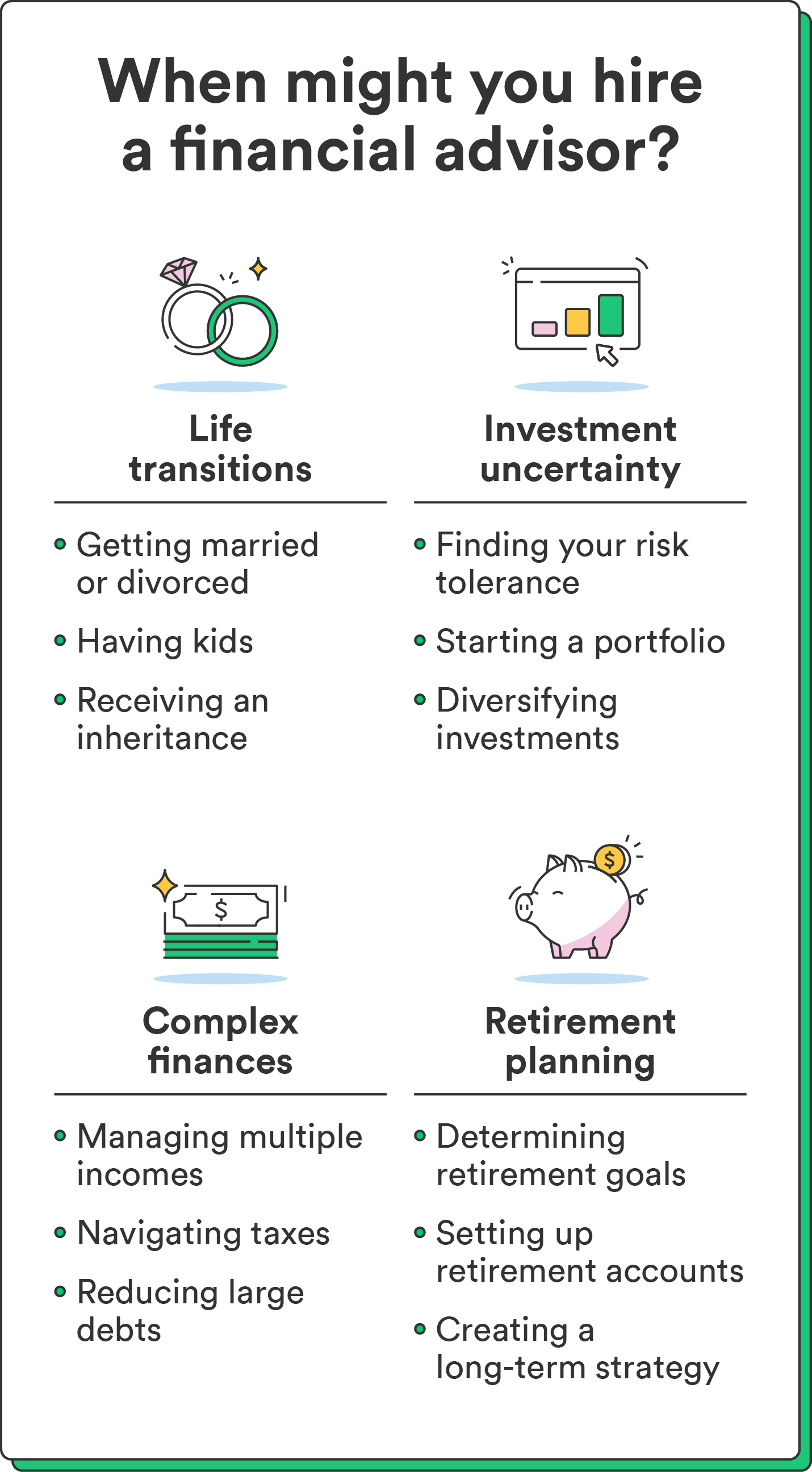

Listen to this article once you hear the phrase financial consultant, what one thinks of? Many people think of a specialist who is able to let them have monetary advice, specially when you are considering spending. That’s a good starting point, however it doesn’t paint the complete image. Not near! Financial experts will help people with a lot of some other money goals too.

A financial specialist will allow you to develop wide range and protect it for your future. Capable approximate your own future economic needs and program how to extend your your retirement savings. They can additionally give you advice on when to begin experiencing personal Security and utilizing the money within your retirement reports to help you stay away from any terrible penalties.

The Greatest Guide To Tax Planning Canada

They're able to make it easier to decide exactly what common resources are best for your needs and demonstrate tips control and work out one particular of the assets. They can also make it easier to see the risks and what you’ll need to do to reach your aims. A seasoned investment expert can also help you remain on the roller coaster of investingeven when your investments take a dive.

They're able to provide direction you'll want to create a strategy so you can be sure that desires are executed. And you can’t put an amount tag from the comfort that accompanies that. Relating to research conducted recently, the typical 65-year-old few in 2022 requires around $315,000 conserved to cover healthcare costs in pension.

Some Known Questions About Tax Planning Canada.

Since we’ve gone over exactly what economic advisors would, let’s dig in to the different types. Here’s a rule of thumb: All financial coordinators are financial analysts, however all advisors tend to be coordinators - https://dribbble.com/lighthousewm/about. A monetary planner focuses on assisting people create intends to achieve long-lasting goalsthings like starting a college account or saving for a down repayment on property

So how do you know which financial expert suits you - https://www.anyflip.com/homepage/megji? Check out things you can do to be sure you’re hiring the proper individual. Where do you turn once you have two poor choices to select? Simple! Get A Hold Of a lot more solutions. The greater amount of choices you may have, the much more likely you happen to be to produce an excellent decision

The Ultimate Guide To Retirement Planning Canada

The wise, Vestor system makes it possible for you by revealing you as much as five economic experts who is able to last. The best part is actually, it is completely free to have regarding an advisor! And don’t forget about to come to the interview ready with a list of concerns to ask to determine if they’re a good fit.But tune in, even though a consultant is smarter than the ordinary bear doesn’t give them the legal right to reveal what to do. Often, analysts are full of by themselves simply because they have significantly more degrees than a thermometer. If an advisor begins talking-down for your requirements, it's time for you demonstrate to them the doorway.

Keep in mind that! It’s essential along with your economic expert (whoever it ultimately ends up becoming) are on the same page. You need a consultant who's got a long-term investing strategysomeone who’ll motivate one keep trading regularly whether the marketplace is up or down. financial advisor victoria bc. You don’t need utilize a person who forces one invest in something which’s as well high-risk or you’re unpleasant with

7 Simple Techniques For Private Wealth Management Canada

That combine gives you the diversity you will need to successfully invest for the long term. When you study economic experts, you’ll probably come across the definition of fiduciary responsibility. All of this means is any advisor you hire has to work in a manner that benefits their particular customer and try this site not their own self-interest.Report this wiki page